Stock markets in Europe, Asia and New York fell on Friday as fears of a US economic crisis rose and technology shares suffered from lower earnings.

Concerns that the U.S. could be headed for recession fueled the global sell-off, which accelerated after Friday’s weak jobs report showed the U.S. jobs market cooling sharply. Which is increasing the rate of unemployment.

Economists worry that the U.S. economy could be weaker than the Federal Reserve’s central bankers, and that could force the Fed to cut borrowing costs sharply in September – or even earlier by cutting the emergency rate. Can – to stimulate demand.

“A sharp slowdown in payrolls in July and a sharp rise in the unemployment rate make an interest rate cut in September inevitable and will increase speculation that the Fed will cut 50bp or even an intra-meeting rate.” will begin its loosening cycle with the move,” Stephen said. Brown, vice president of capital economics, North American economist.

The weak jobs report added to concerns after this week’s data showed weakness in the US manufacturing sector, and disappointing results from semiconductor maker Intel, which sent its shares hurt.

People are attending the job fair.

Weak U.S. jobs growth for July sparked a sell-off on Wall Street.

Read more:

The tech-focused Nasdaq index fell nearly 3 percent in early trading and was on course for a correction — 10 percent from its record high — after the latest U.S. nonfarm payrolls report showed just 114,000 jobs were created last month. , expected 175,000 analysts. In another blow, the U.S. unemployment rate rose to 4.3 percent from 4.1 percent.

Japanese equities suffered their worst day of 2020 after the Covid-19 pandemic rocked markets. The Nikkei 225 share index fell 5.8 percent to its lowest closing level since January. The broader Japanese topex fell 6.1 percent, Australia’s ASX fell 2.5 percent and Hong Kong’s Hang Seng fell 2.1 percent.

Europe’s main stock indexes also fell on Friday, with European technology stocks hitting their lowest levels in more than six months. France’s CAC 40 fell to its lowest level since last November, down more than 1%, while Germany’s DEX fell 2%.

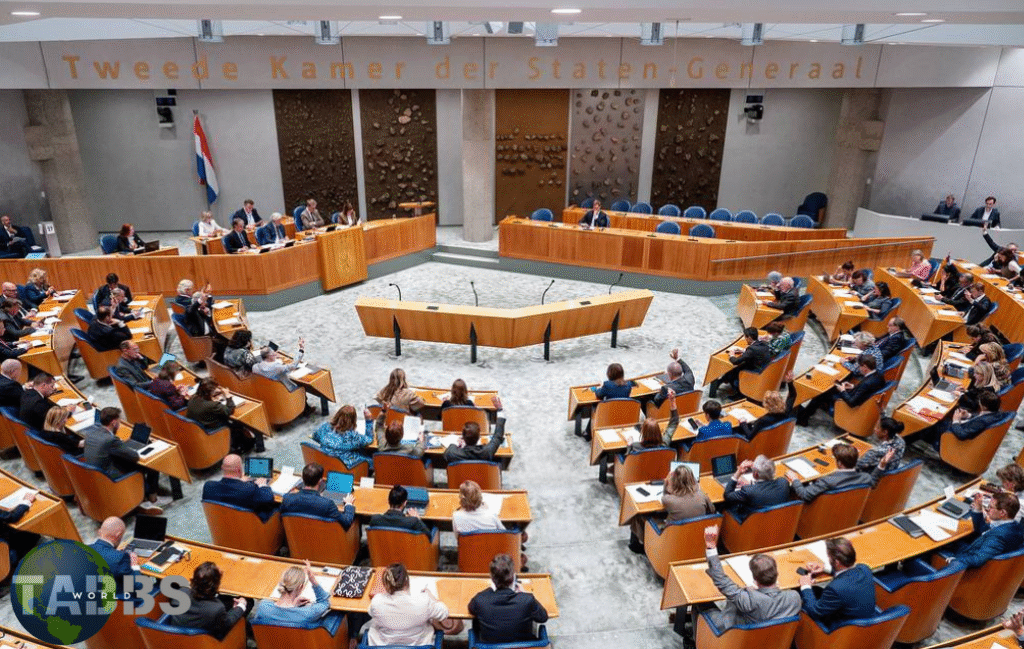

Shares in Dutch chipmaker ASML fell 9.6%, while shares in rival ASM International fell 13.7%.

“The past 24 hours has seen an increasingly dovish backdrop for risk markets,” said Deutsche Bank analyst Jim Reid, who saw a risk-on mood on the back of another batch of weak US data yesterday. has gone, after which most of the tech was earned overnight”. , Friday morning.

In London, the FTSE 100 blue-chip share index lost more than 120 points, down 1.5 percent at one stage.

Friday’s Market selloff followed a rough day of trading on Wall Street Thursday, where the Dow Jones industrial average fell 1.2 percent, or nearly 500 points. It was triggered by data showing US manufacturing activity fell to an eight-month low in July amid a drop in new orders, and new claims for unemployment benefits. US job growth hits 11-month high.

Data on Friday showed that new orders for US manufactured goods fell 3.3 percent in June, adding to concerns that economic demand is fading. The Fed left US interest rates on hold on Wednesday, but hinted that a rate cut is imminent.

Financial markets are now pricing in a 100% chance that the Fed will cut rates in September, with a large, half-point cut as a 60% chance after a weak jobs report.

“The Fed remains cautious about inflation, but this week’s employment cost index and unit labor cost data should have really boosted their confidence that inflation is on track for 2%. ING chief The international economist, James Knightley, said their focus should be on the state of the job market.

The US dollar weakened, with the pound gaining 0.5 percent to $1.28 and the euro up 1.2 percent to $1.092.

Intel shares fell more than 28 percent after it announced plans to cut more than 15,000 jobs globally as it seeks to “size and refocus” its business. Amazon shares fell 10 percent after missing sales forecasts and analysts were disappointed by its latest outlook.

Shares of chip maker Nvidia fell 2.7 percent after reports that the U.S. Justice Department has opened an investigation into complaints from rivals that it abused its market dominance in selling chips that power artificial intelligence. What is it.

Russ Mould, an investment director at AJ Bell, said the growing economic depression meant August was off to a bad start for global stock markets.

“The economy going through a bad patch is a catalyst for the central bank to cut rates and hopefully stimulate activity,” he said. “This thought process is likely to top the Fed’s agenda this week after US economic data that highlighted expected jobless claims and a contraction in manufacturing. The narrative has shifted from rate cuts to good news that Means measures to avoid recession.

Amid lower share prices, gold hit a fresh record on Friday as investors turned to safe-haven assets. Gold futures were up $25.70 (£20.17), or 1%, at $2,506.40 an ounce at a point on Friday.